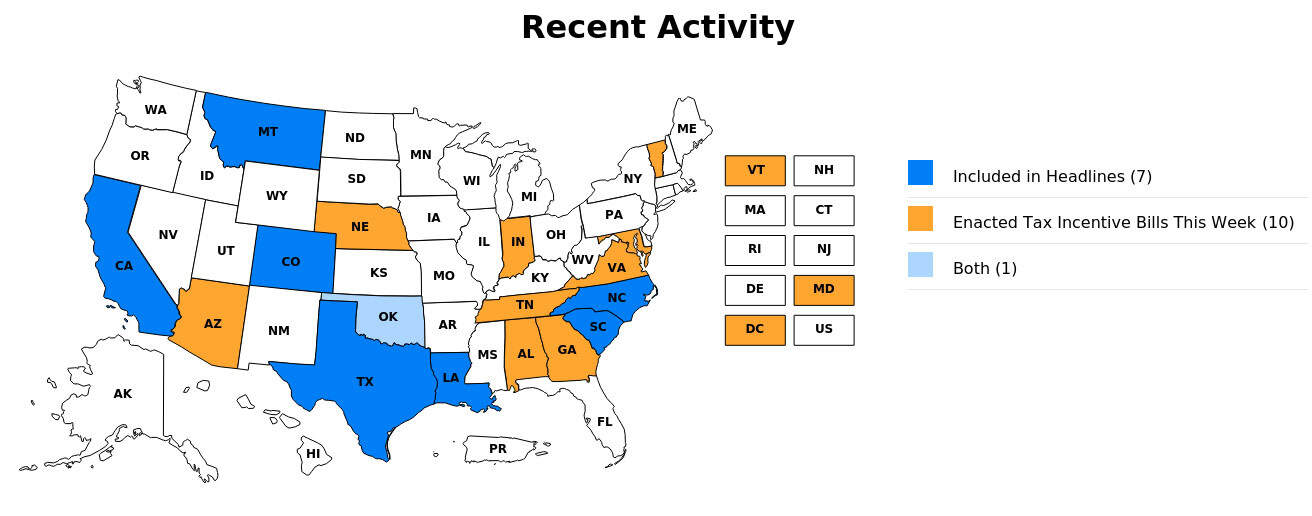

Here is the FOCUS spotlight on news which provides a “temperature check” on state and local appetites for business tax incentives.

Newsom wants a federal tax credit to save Hollywood. Why that’s a long shot.

California: LA Times: In response to Republican President Donald Trump’s proposal to impose tariffs on foreign-made films, California Democratic Gov. Gavin Newsom has proposed a $7.5 billion federal tax incentive aimed at keeping more film and television production within the United States. Despite their political differences, Governor Newsom reached out to the Trump administration to collaborate on the initiative, which received support from several Hollywood unions and industry trade groups, including the Motion Picture Association and guilds representing writers, directors, and actors. Actor Jon Voigt has presented President Trump with a similar plan, featuring a 10–20% federal tax credit.

Flat tax, credit rollbacks proposed to tackle soaring insurance premiums

Louisiana: The Center Square: Louisiana lawmakers have advanced two insurance-related bills aimed at reducing high premium costs and simplifying the state’s tax code. HB 475 proposes raising the annual cap on refundable credits for retaliatory taxes paid by Louisiana-based insurers to other states from $9 million to $25 million and would extend the program’s expiration from 2029 to 2034. HB 594 seeks a broader overhaul of the insurance premium tax structure by replacing the current variable tax rates with a flat 1.6% rate on gross annual premiums starting in 2026. It would repeal several tax credits, including the Insurance Premium Investment Tax Credit and the Capital Companies Tax Credit Program, while retaining local exemptions for qualifying investments. Amendments adopted by the House Ways and Means Committee would reintroduce the retaliatory tax credit and limit some repeals, while also allowing the premium tax rate to decrease by 0.2% annually beginning in 2027 if tax collections exceed 2024 levels. Both bills await further review in the House.

R&D Tax Credit Boost Shows Texas Is Not Resting On Low Tax Laurels

Multi-state Trends: Forbes: In a wave of recent tax reform activity across multiple states, Montana recently enacted its largest-ever income tax cut and the South Carolina House advanced a bill aiming to reduce its top income tax rate to a flat 1.99%, mirroring a similar proposal passed by the North Carolina Senate three weeks earlier that is contingent on revenue triggers. Oklahoma also moved forward with a plan to gradually eliminate its state income tax. Meanwhile, Texas lawmakers are reinforcing the state’s competitive edge despite having no income tax, with the Senate’s unanimously passage of SB 2206, which would extend and increase the state’s research and development (R&D) tax credit from 5% to 8.722%, and up to 10.903% for R&D partnerships with Texas universities.

Two tax-break expansions overcoming obstacle, advancing through Legislature

Colorado: The Sum & Substance: Despite a tight budget that blocked many revenue-reducing bills, Colorado legislators advanced two targeted tax credit expansions likely to reach Democratic Gov. Jared Polis’ desk. HB 1021 would extend and expand the state’s employee-ownership tax credit through 2031, increasing the annual cap to $3 million and raising the reimbursable portion of conversion costs from 50% to 75%, while adding deductions for business owners, worker-owned cooperatives and support nonprofits. HB 1157 would extend Colorado’s advanced industries tax credit through 2031, lower the ownership threshold for investor eligibility from 50% to 30% and maintain the credit’s 25% rate on investments in sectors like aerospace and bioscience, though with a reduced annual cap of $2.5 million. Both bills received strong bipartisan support in the House.